0% Finance

We understand that taking care of pets when they are injured or ill can be daunting, and sometimes financially challenging. Finance is a great way to spread the cost of your veterinary care. For your peace of mind, we’ve teamed up with Omni whose technology lets you apply for and complete a loan application quickly, easily and informatively.

Our 0% finance can be used to help you manage payment of larger bills such as:

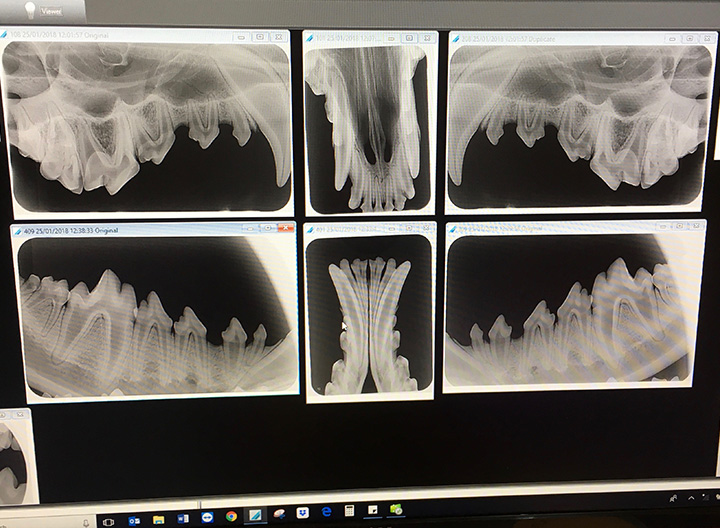

- Dental procedures

- Orthopaedic surgeries

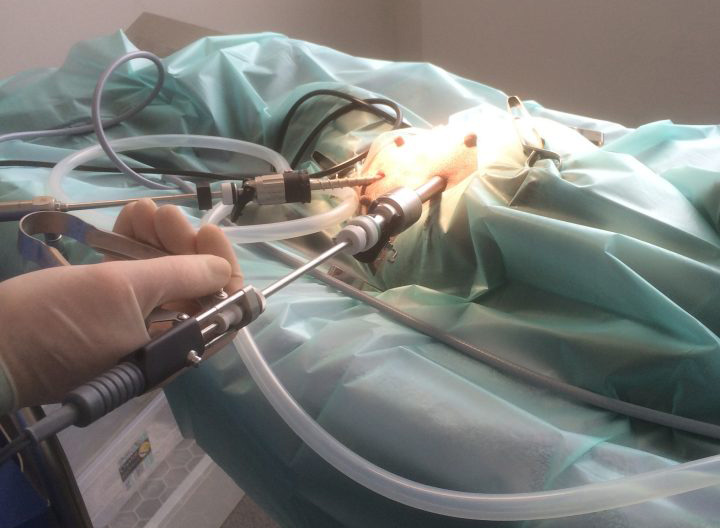

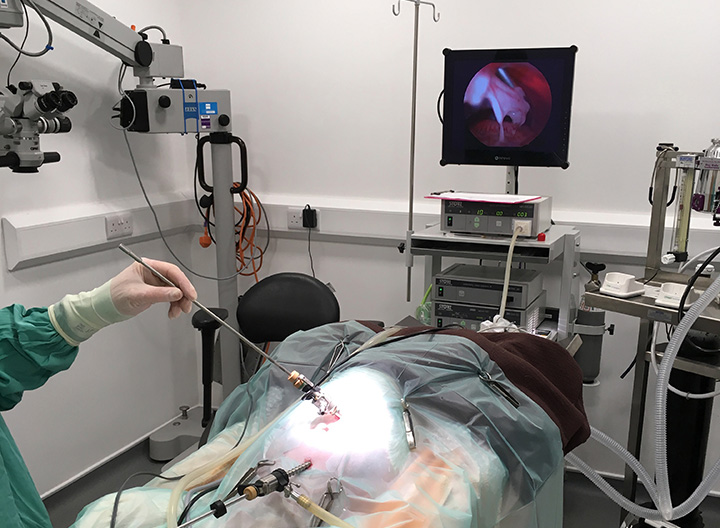

- Laparoscopic surgeries

- Diagnostics – X-rays, heart scanning

Are you thinking of spreading the cost of veterinary care?

Finance is a great way to spread the cost of your purchase, if used responsibly. We have teamed up with Omni, one of the UK’s leading finance specialists, so that you can apply for and complete a loan application quickly and easily – the online application process only takes a couple of minutes to complete, and you will receive confirmation of whether your application has been successful, or referred for further consideration, instantly.

More about our finance options

Our monthly payment plans are designed to help make caring for your pet more affordable. It’s important to remember that you should only enter into a finance agreement if you are sure you can afford the repayments for the full term of the loan. Whichever finance option you choose to apply for, you need to be sure that you can afford to pay the deposit, and keep up with your monthly repayments. You should think about any changes to your situation that might occur during the term of the loan, which could affect your income or expenditure, for example – retirement, moving home, changing jobs, or any health issues.

How long does it take?

The online application will take around five minutes for the customer care team at your practice to complete, and the decision is instant. Please note this should be done prior to any procedure bookings as the application is subject to a credit check and on occasion, alternative arrangements may need to be made.

How much can I apply for?

We offer a range of interest-free and interest bearing finance options to help you spread the cost over 6, 12, 18 and 24 months. The value of the loan needs to be between £250 – £15,000 and you can choose a deposit from 1% to 50%. The application takes around 5 minutes to complete from the Application Link the Customer Care team will send to you, if you require any assistance the Care team can help you with the application.

| Term Months | APR |

| 6 | 0.00% |

| 12 | 0.00% |

| 18 | 0.00% |

| 24 | 0.00% |

| 36 | 0.00% |

Check your eligibility

You will only be considered for finance if you:

- Are at least 18 years old

- You’re in paid employment or have a regular income (minimum 16 hours per week or £5,000 per annum, unless you are retired and receiving a private / company pension or in receipt of disability allowance)

- Are a permanent UK resident and have lived in the UK for at least 3 years

- Have a UK bank account capable of accepting Direct Debits

- Have a good credit history with no late payments, debt relief orders, County Court Judgment (CCJs), Individual Voluntary Arrangement (IVAs) or bankruptcies

- Provide an email address so your documentation can be emailed to you

Will a credit search be registered against me if I apply?

Omni will perform a ‘soft’ credit search on your credit file as part of their assessment, to determine whether the loan is affordable for you and if you are likely to make your repayments on time. It’s important to know that an application for credit will only result in a ‘soft’ search on your credit file until the point your application for finance is complete, at which point a ‘hard’ credit check will be recorded on your credit file. Only you can see that a ‘soft’ search has been made on your credit file, but a ‘hard’ credit check will be visible to others viewing your credit file, for example, if you apply for credit in the future, the lender will see that an application credit search was made on your credit file.

Representative example:

0% finance over 12 months

Total order value = £600

10% deposit = £60

Total amount of credit = £540

Duration = 12 months

Representative APR = 0%

Interest charged = £0

12 monthly payments of = £45

Total amount payable = £600

Managing the loan

Your first direct debit payment will be taken approximately 30 days after it is activated. This will show on your statement as a payment to Omni. You can request to change your monthly payment date after the first payment has been made by contacting Omni and speaking to their customer services team on 0333 240 8317. You will also be registered for their Customer Self Service portal, where you will be able to change the payment date yourself.

How can I contact the lender to discuss my loan?

There are three ways to contact Omni:

Through the Customer Self Service Portal

By email at customerenquiries@ocrf.co.uk

By telephone on 0333 240 8317

Are there any fees for repaying my loan early?

There may be a fee for early repayment depending on the type of loan. Your Credit Agreement will detail the

applicable fees for your product.

Can I cancel my finance agreement?

You have 14 days to cancel your credit agreement, please note that cancelling your finance agreement with Omni will mean payment for the veterinary services will still be required.

Financial Disclosure

DNA Vetcare Ltd is registered in England and Wales with company number 05185406. Our registered address is 105 Humber Road, London, SE3 7LW. DNA Vetcare is authorised and regulated by the Financial Conduct Authority, register number 735700. DNA Vetcare acts as a credit broker and offers credit products exclusively from Omni Capital Retail Finance.

Finance is provided by Omni Capital Retail Finance Ltd which is a credit provider/lender. DNA Vetcare does not receive payment for introducing customers to Omni Capital Retail Finance. Omni Capital Retail Finance Ltd finance options are subject to individual status, and terms and conditions apply. Your application will be subject to a credit check using a recognised credit reference agency as part of our assessment process. You can find Omni Capital Retail Finance’s Terms and Conditions at www.omnicapitalretailfinance.co.uk.

Omni Capital Retail Finance Ltd is registered in England and Wales with company number 7232938. Registered address: 10 Norwich Street, London, EC4A 1BD. Authorised and regulated by the Financial Conduct Authority, Firm Reference Number: 720279.